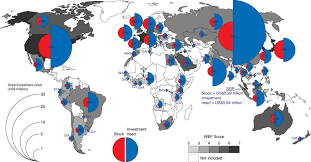

Investor sentiment around the world is improving as inflation cools and expectations for monetary easing strengthen, signaling a potential recovery in global risk appetite.

Market Confidence Returns After a Volatile Year

Following months of uncertainty, global equities have regained stability. The MSCI World Index rose 2.5% in October, driven by positive earnings reports and signs of easing inflation across major economies. Analysts note that investors are beginning to re-enter markets with renewed optimism.

Inflation Data Boosts Optimism

Recent inflation figures from the United States, Eurozone, and Japan have shown steady declines, easing fears of prolonged monetary tightening. As inflation expectations fall, capital is flowing back into equities, commodities, and emerging markets.

Institutional Investors Lead the Turnaround

Large asset managers and hedge funds are increasing exposure to growth-oriented assets, particularly in technology and renewable energy sectors. Exchange-traded funds (ETFs) tied to global equity indices have seen inflows exceeding $20 billion in the past month alone.

Risks Temper the Positive Mood

Despite the optimism, analysts warn that geopolitical instability and potential supply chain shocks could dampen the recovery. Many investors continue to hedge portfolios with gold and short-term bonds as a safeguard against sudden volatility.