As markets enter a new cycle of volatility and uncertainty, global investors are shifting portfolio strategies toward diversification, resilience, and long-term value creation.

Diversification Replaces Speculation

With interest rates stabilizing and inflation slowly retreating, investors are moving away from short-term speculation. The focus has shifted toward multi-asset portfolios combining equities, bonds, commodities, and alternative assets such as infrastructure and private equity.

Rise of Thematic and ESG Investing

Sustainability and technology-driven themes dominate global capital flows. ESG (Environmental, Social, and Governance) funds now represent over 25% of total assets under management, while clean energy, AI, and healthcare innovation remain top long-term bets.

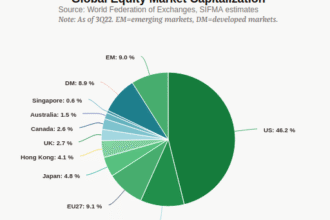

Regional Balancing Gains Importance

Portfolio managers are diversifying geographically to reduce exposure to regional shocks. North America remains a stability anchor, while Asia and the Middle East are attracting strategic capital due to demographic and industrial growth.

Strategic Patience Becomes the Core Principle

Amid macroeconomic uncertainty, investors are adopting “strategic patience” — favoring steady compounding and capital preservation over aggressive short-term gains. The new mantra: fewer moves, stronger convictions.